Deal Activity

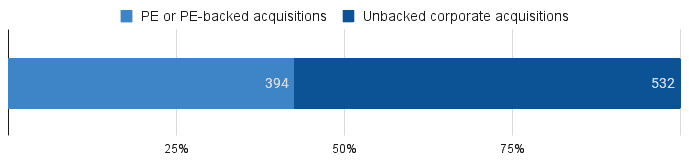

Growthink Capital Research tracked 926 closed Mergers & Acquisition transactions in January 2024 with U.S. targets, compared to the 729 tracked in December 2023.

This total includes 394 Private Equity or Private Equity-backed acquisitions and 532 by corporate acquirers.

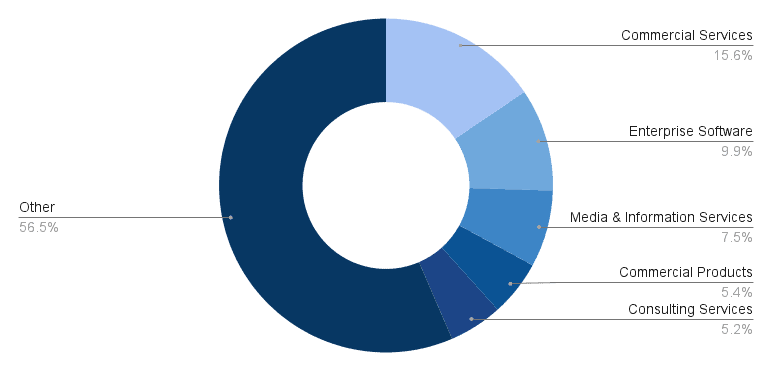

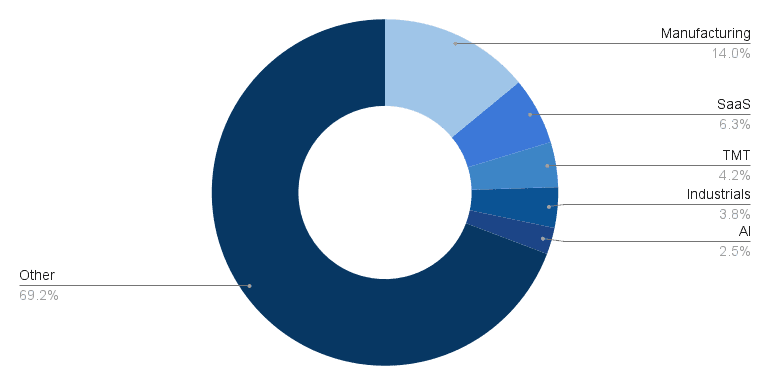

Top Industries and Segments

The top 5 associated industries by number of completed transactions were Commercial Services, Enterprise Software, Media & Information Services, Commercial Products, and Consulting Services.

The top 5 associated verticals were Manufacturing, SaaS, TMT, Industrials and AI. Fragmentation by vertical has increased (with top 5 verticals representing merely 31% of total transactions), while the spectrum of verticals has broadened, with more sectors currently seeing M&A activity.

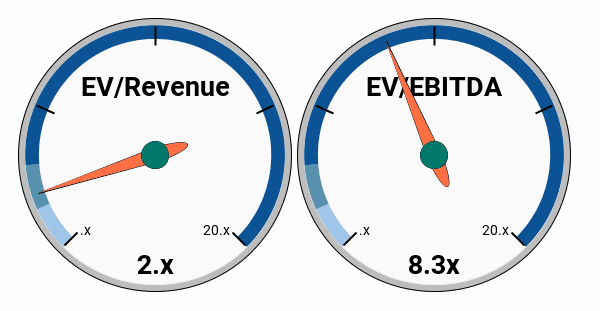

Revenue and Earnings Multiples

Growthink Capital derived a Median EV/Rev multiple of 2.0x and a Median EV/EBITDA multiple of 8.3x (excluding negative EBITDA companies) from the transactions that disclose the enterprise value as well as revenue and/or EBITDA information.

The median deal size was $175M, compared to $171M in December 2023.

The Biggest Deal

Beyond Realty Income (NYS:O) $9.3 billion acquisition of Spirit Realty Capital, a REIT primarily involved in leasing properties throughout the US, the largest deal this month has been the acquisition of EngageSmart by Vista Equity Partners for $4 billion.

Engagesmart Inc is a provider of single instance, multi-tenant, true Software-as-a-Service vertical solutions that are designed to simplify customers’ engagement with clients by driving digital adoption and self-service.

The transaction announced in October 2023 was completed on January 26, 2024 through a $4 billion public-to-private LBO led by Vista Equity Partners, valuing the EngageSmart at an estimated $6.1 billion.

With reported revenue of $364.47 million and $64.84 million in EBITDA, we can derive an implicit EV/Revenue multiple of 16.9x and an implicit EV/EBITDA multiple of 94.9x.

The Oldest and the Newest

One of the oldest companies to sell in January 2024 was 1858-founded Stone Insurance Agency, a provider of insurance brokerage and risk management services intended for commercial and personal lines clients. The company offers home, auto, flood, business and marine insurance services including technology, enabling its clients in the manufacturing, retail and e-commerce, industrial services and property maintenance sectors with their desired financial assistance for their purposes.

The company was acquired by Risk Strategies Company, via its financial sponsors Kelso & Company and HarbourVest Partners, through an LBO (leveraged buyout) on January 17, 2024 for an undisclosed amount.

The most recently-founded company to achieve an exit last month was Cathbad House LLC, a provider of training and educational services intended for farmers, foresters, small and mid-size businesses. The company, doing business as “Cathbad Trading”, focuses on carbon credit education and blockchain technology to promote sustainable practices for a greener future.

Established a mere 7 months ago, the company was acquired by Matter Now, a leader in the carbon credit marketplace, for an undisclosed amount on January 9, 2024. The acquisition will help Matter Now to empower a wider audience with the knowledge and tools needed to make a tangible impact in the fight against climate change.

New Mandates

The Growthink Capital team is currently looking to identify a US-based contract manufacturer of color cosmetic products on behalf of a sizeable European CDMO that aims to expand its North American operations. Please get in touch if you operate or know of a company that could be a fit.

Growthink Capital’s Transaction of the Month

Launchmetrics, a marketing and analytics platform facilitating industry connectivity and media performance enhancement, was acquired by Lectra (PAR: LSS) on January 22, 2024.

Lectra, a French company that focuses on providing technology solutions for industries like fashion, automotive, and furniture, acquired approximately 50.3% of Launchmetrics for $85 million in January 2024, with plans for phased acquisition of the remaining capital and voting rights over the next few years. The total acquisition price is estimated to range between $200 and $240 million.

Prior to this transaction, Launchmetrics had received substantial development capital from Mirabaud Private Equity, Entrepreneur Invest and Bpifrance.

With the last reported revenue of $45 million and $5 million in EBITDA, we can derive an implicit EV/Revenue multiple of 4.9x and an implicit EV/EBITDA multiple of 44x.

Let’s delve into the transaction and explore its anticipated synergies:

-

Strategic Fit: The acquisition aligns the strengths of Launchmetrics’ marketing analytics with Lectra’s technology solutions.

-

Complementary Services: Launchmetrics’ analytics complement Lectra’s existing offerings, enhancing efficiency and productivity.

-

Market Expansion & Global Reach: Lectra gains access to a broader customer base, while Launchmetrics benefits from existing relationships. While both companies already operate globally, the acquisition strengthens their combined global presence.

-

Data Synergies & Innovation: Both companies can leverage each other’s data to enhance insights and decision-making. Integrating analytics and technology drives innovation and operational efficiencies.

To explore M&A alternatives for your business – whether that be pursuing a sale of the company, liquidity for shareholders, or growth-by-acquisition opportunities – please reply to this email, call us at (213) 927-3968, or learn more about our services on our website.

Securities transactions are conducted through GT Securities, Inc. Member FINRA/SIPC. Nothing in this email should be regarded as an offer to sell or a solicitation of an offer to buy any Investment.