Deal Activity

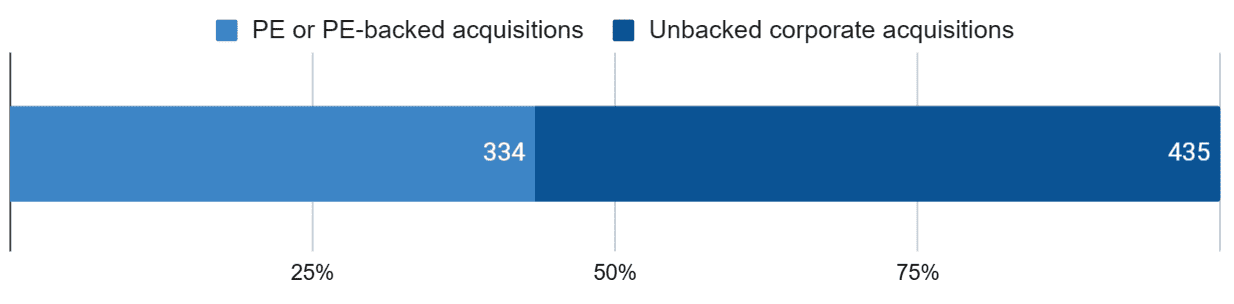

Growthink Capital Research tracked 769 closed Mergers & Acquisition transactions in February 2024 with U.S. targets, compared to the 926 tracked in January 2024 and 729 in December 2023.

This total includes 334 Private Equity or Private Equity-backed acquisitions and 435 by corporate acquirers.

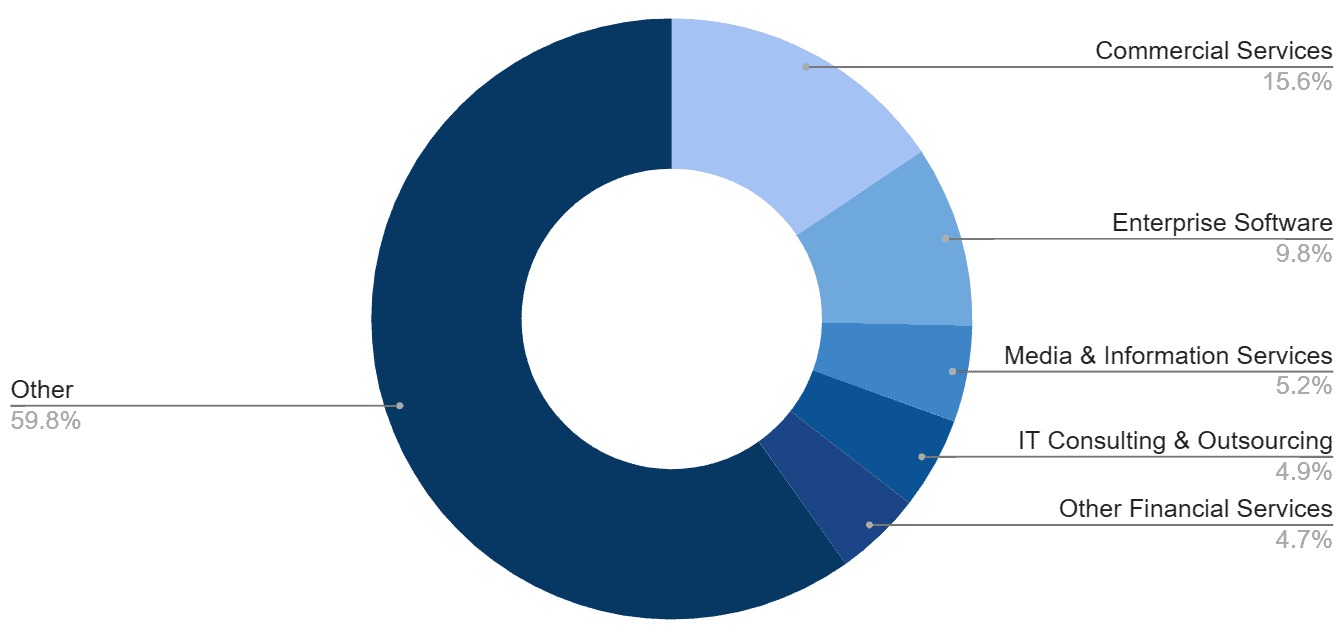

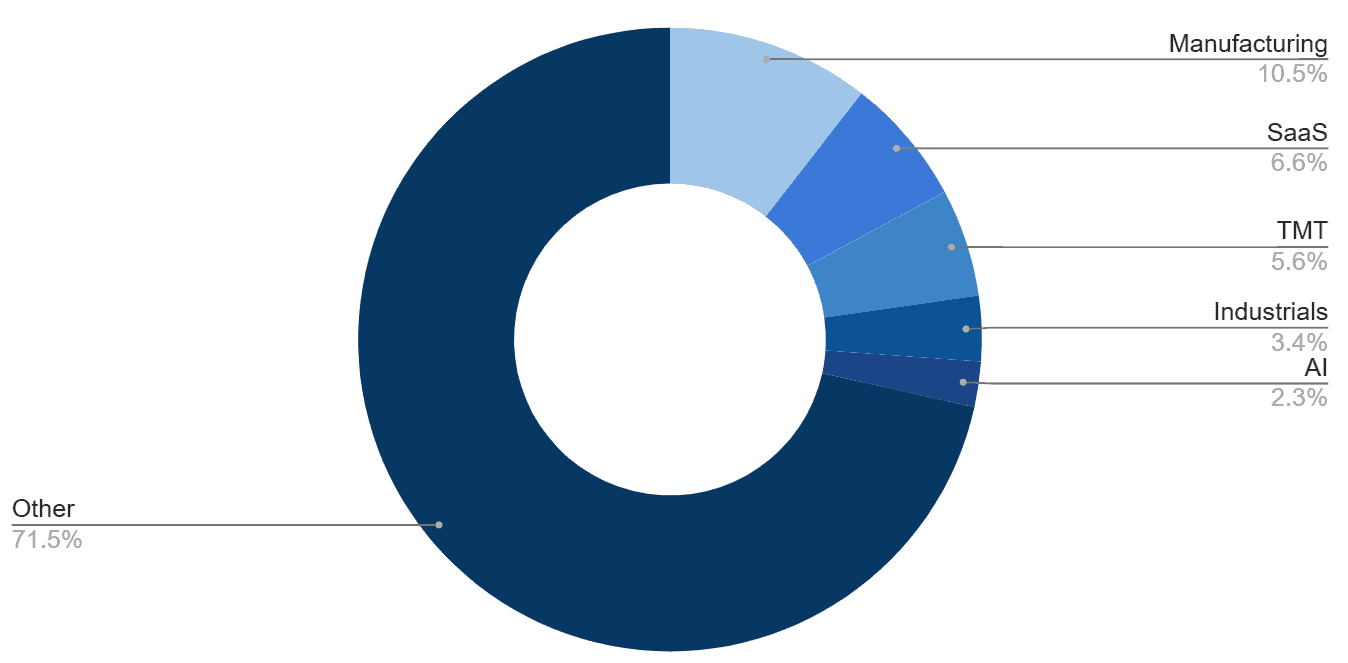

Top Industries and Segments

The top 5 associated industries by number of completed transactions were Commercial Services, Enterprise Software, Media & Information Services, IT Consulting & Outsourcing, and Other Financial Services.

The top 5 associated verticals remained consistent with those from January 2024 and were Manufacturing, SaaS, TMT, Industrials and AI. Fragmentation by vertical remains high, with the top 5 verticals representing merely 28% of total transactions.

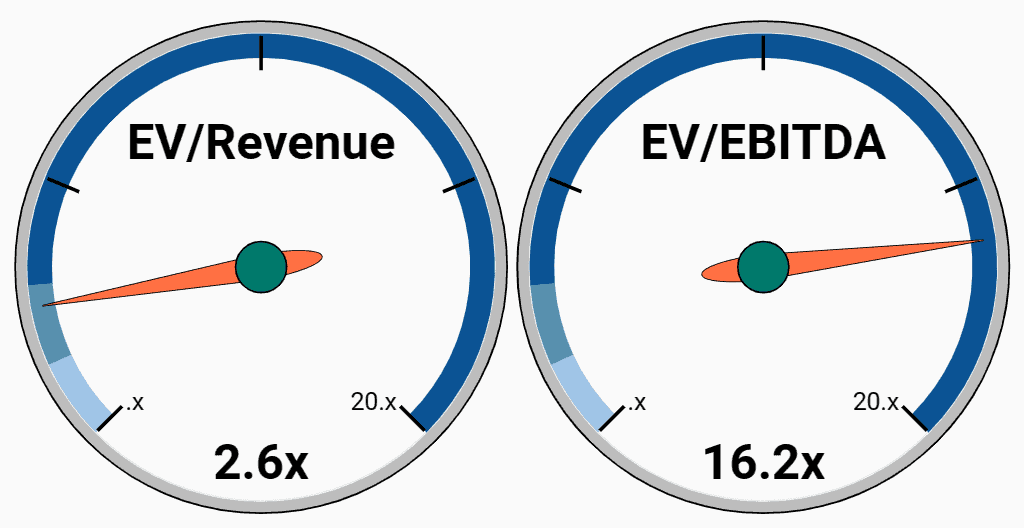

Revenue and Earnings Multiples

From the transactions that disclose the valuation as well as revenue and/or EBITDA information, Growthink Capital derived a median valuation multiple of Revenue of 2.6x and a median multiple of EBITDA of 16.2x (excluding negative EBITDA companies).

The median deal size of $92 million remains consistent with the $93.5 million observed in February 2024.

Growthink Capital’s Transaction of the Month

QX Networking & Design, Inc. (dba QX.net) is a Lexington, KY-based independent internet service provider (ISP) serving local businesses with a complete suite of business communication tools, including internet, SDWAN service, and colocation services.

Growthink Capital was engaged to facilitate QX.net sale to a strategic buyer. The process guided an acquisition of QX.net by telecommunications company EarthLink® via its financial sponsor Thrive Capital (a private equity group with over $4 billion in capital commitments). At the time of the transaction, QX.net was valued at 2x its gross revenue.

Over the past 12 months, Earthlink has acquired three companies in the fixed wireless space. Along with One Ring Networks and Telegia, QX.net will enable Earthlink to expand its offering and bring personalized internet services to businesses across Kentucky.

“We are thrilled with the outcome for the QX team. This was a process of persistence as we identified many potential suitors and ultimately secured the best partner for the Company. Kudos to everyone for their hard work on this deal and congratulations to all parties involved.” commented Jeff Jones, Vice President at Growthink Capital and Lead Advisor on the transaction.

The Biggest Deals

Rocky Terrain Ventures, a provider of oil exploration services based in the Permian Basin, was acquired by Energy Titan for $25 billion on February 12, 2024. The Permian Basin is a large sedimentary depression across Texas and New Mexico, known to be the highest producing oil field in the U.S.

Also on February 12, Immunogen (NAS: IMGN) was acquired by AbbVie (NYS: ABBV) for $10.1 billion. Immunogen is a clinical-stage biotechnology company focusing on antibody-drug conjugate (ADC) technology, which uses an antibody on tumor cells to deliver a specific cancer-killing agent. The acquisition enables AbbVie to further diversify its oncology pipeline across solid tumors and hematologic malignancies.

With the last reported revenue of $288 million (and a negative EBITDA -$74 million), the implicit valuation multiple was 35.1x its revenue.

Space & Mission Systems (previously known as “Ball Aerospace”, and subsidiary of Ball (NYSE: BALL)), was acquired by BAE Systems (LON: BA) for $5.55 billion in cash on February 16, 2024.

Space & Mission Systems specializes in space-based instruments and sensors, tactical electro-optical solutions, antennas, microwave systems and aerospace components, along with engineering services supporting critical missions for national agencies.

The acquisition will enable BAE Systems to offer an increased range of technologies in spacecraft, instruments, ground systems, sensors, tactical systems, operations, data analytics and other defense and civil systems.

With the last reported revenue of $2.2 billion and an EBITDA of $310 million, the implicit valuation multiples were 2.52x its revenue and 17.90x its EBITDA.

The Oldest and the Newest

There were 7 companies founded in the 1800s that were acquired in February 2024.

One of the oldest companies to sell last month was Hoffman Sausage Company. Founded in 1879 in Syracuse, NY, the company offers hot dogs, sausages & German frankfurters, German mustard and deli items.

The company was acquired by Miami Beef Company, via its financial sponsor Trivest Partners, through a Leveraged Buyout (LBO) on February 13, 2024 for an undisclosed amount.

Miami Beef serves retail and foodservice nationwide through its brands Miami Beef, Free Graze, Florida Raised, Sizzle King, Young Ridge, Brooklyn Burger and Devault Foods. The addition of Hoffmann’s sausages and hot dogs to the menu gives their customers the full grilling experience. The company will operate off its South Florida and Central New York based facilities.

Many recently-founded companies to achieve an exit last month: 7 companies founded in 2023 and 3 in 2024.

One of these is Aiolos Bio, a clinical-stage biopharmaceutical company addressing the unmet treatment needs of patients with respiratory conditions.

Founded in October 2023 by Khurem Farooq and Tony Adamis, MD, the company was acquired by GSK (LON: GSK) for $1.4 billion on February 15, 2024. The company will receive a contingent payout of $400 million upon the completion of certain success-based regulatory milestones.

The acquisition of Aiolos includes AIO-001, a potentially best-in-class antibody ready to enter phase II clinical development for the treatment of adult patients with asthma. AIO-001 could expand GSK’s respiratory biologics portfolio to potentially offer a long-acting biologic to a broader portion of the 315 million patients living with asthma.

Previously, the company raised $245 million through the combination of Series A, Series A-1, and Series A-2 venture funding in a deal led by Atlas Venture, Bain Capital Life Sciences, Forbion, and Sofinnova Investments on October 24, 2023, putting the company’s pre-money valuation at $195 million.

New Mandates

The Growthink Capital team was engaged to raise a $10+ million growth round for a tech-enabled, last-mile delivery platform with warehousing and delivery services based in California. This bootstrapped and EBITDA-positive Company grossed over $30 million in 2023, a 370% growth from 2022. Please get in touch directly if you operate or work with a financial or strategic investor that would find this investment synergistic.

To explore M&A alternatives for your business – whether that be pursuing a sale of the company, liquidity for shareholders, or growth-by-acquisition opportunities – please reply to this email, call us at (213) 927-3968, or learn more about our services on our website.

Securities transactions are conducted through GT Securities, Inc. Member FINRA/SIPC. Nothing in this email should be regarded as an offer to sell or a solicitation of an offer to buy any Investment.