Deal Activity

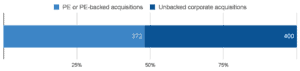

In November 2023, Growthink Capital Research tracked 772 closed Mergers & Acquisition transactions with U.S. targets, compared to the 917 tracked in October 2023.

This total includes 372 Private Equity or Private Equity-backed acquisitions and 400 by corporate acquirers.

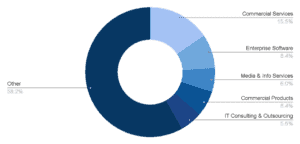

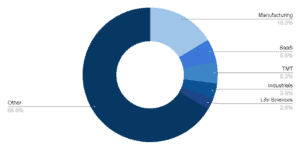

Top Industries and Segments

The top 5 associated industries were Commercial Services, Enterprise Software, Media & Information Services, Commercial Products, and IT Consulting & Outsourcing.

The top 5 associated verticals were Manufacturing, SaaS, TMT, Industrials, and Life Sciences.

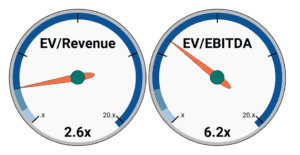

Revenue and Earnings Multiples

Growthink Capital derived a Median EV/Rev multiple of 2.59x and a Median EV/EBITDA multiple of 6.16x from the 87 transactions that disclose the enterprise value as well as revenue and/or EBITDA information.

The median deal size was $300M, compared to $108M in October 2023.

The Biggest Deal

Beyond the acquisition of VMware by Broadcom (NAS: AVGO) for $69 billion -after being in process for well over a year- the largest deal this month has been the acquisition of Adenza by Nasdaq (NAS: NDAQ) for $10.5 billion on November 1, 2023.

Adenza provides cloud-enabled front-to-back technology software for financial markets: its acquisition allows Nasdaq to expand its capabilities to support the world’s financial institutions with mission-critical solutions designed to manage risk and compliance, strengthen integrity, and enhance market and trading infrastructure. Adenza reported $514 million revenue and $339 million EBITDA in 2022 (indicating an implicit 20x multiple of revenue and 31x multiple of EBITDA).

The Oldest and the Newest

The oldest company to sell in November 2023 was 1808-founded Revere Ware, manufacturer of copper-clad stainless-steel kitchenware, acquired by Full Sail IP Partners, via its financial sponsor Warburg Pincus, through an LBO on November 7 for an undisclosed amount.

The most recently-founded company to achieve an exit last month was CanFy, a developer of a full stack LLM (large language model, a type of artificial intelligence algorithm) platform intended to aid extra security and privacy, acquired by Playbook, an Enterprise Software provider, for an undisclosed amount on November 7.

CanFy was only founded in June 2023, therefore it only took 6 months for Co-Founders Max Kushner and Alex Gaziev to exit!

Growthink Capital’s Transaction of the Month

Avidity Science specializes in automated drinking water systems, environmental monitoring with light control, water treatment and purification systems and livestock watering and cooling for pharmaceutical, educational, governmental, biotechnology and agricultural markets.

The company was acquired by ATS Automation Tooling Systems (TSE: ATS) for $195 million on November 17, 2023.

Avidity Science had reported Revenue of $81.9 million and a Normalized EBITDA of $16.7 million in December 2022, resulting in an implicit multiple of 2.4x times Revenue or 11.7x times EBITDA.

On a last note, it may be a coincidence, but the company is headquartered in Waterford, WI.

To explore M&A alternatives for your business – whether that be pursuing a sale of the company, liquidity for shareholders, or growth-by-acquisition opportunities – please reply to this email, call us at (213) 927-3968, or learn more about our services on our website.

Securities transactions are conducted through GT Securities, Inc. Member FINRA/SIPC. Nothing in this email should be regarded as an offer to sell or a solicitation of an offer to buy any Investment.