Deal Activity

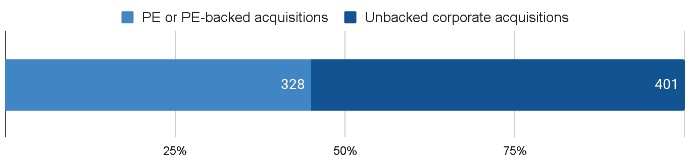

In December 2023, Growthink Capital Research tracked 729 closed Mergers & Acquisition transactions with U.S. targets, compared to the 772 tracked in November 2023.

This total includes 328 Private Equity or Private Equity-backed acquisitions and 401 by corporate acquirers.

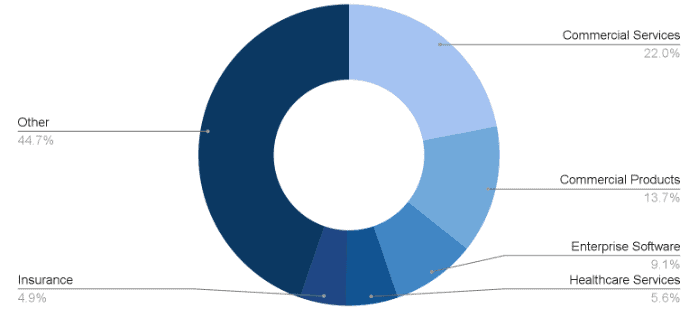

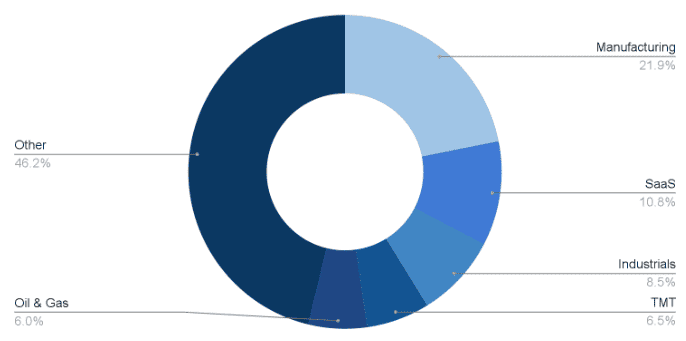

Top Industries and Segments

The top 5 associated industries were Commercial Services, Commercial Products, Enterprise Software, Healthcare Services, and Insurance.

The top 5 associated verticals were Manufacturing, SaaS, Industrials, TMT, and Oil & Gas.

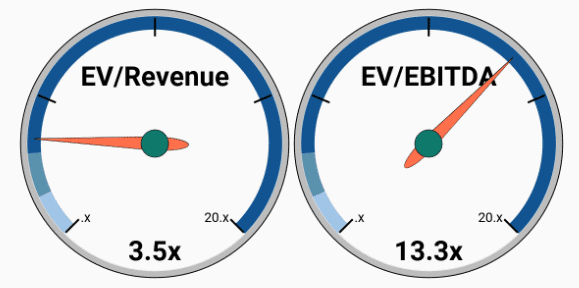

Revenue and Earnings Multiples

Growthink Capital derived a Median EV/Rev multiple of 3.5x and a Median EV/EBITDA multiple of 13.3x (excluding negative EBITDA companies) from the transactions that disclose the enterprise value as well as revenue and/or EBITDA information.

The median deal size was $171M, compared to $300M in November and $108M in October 2023.

The Biggest Deal

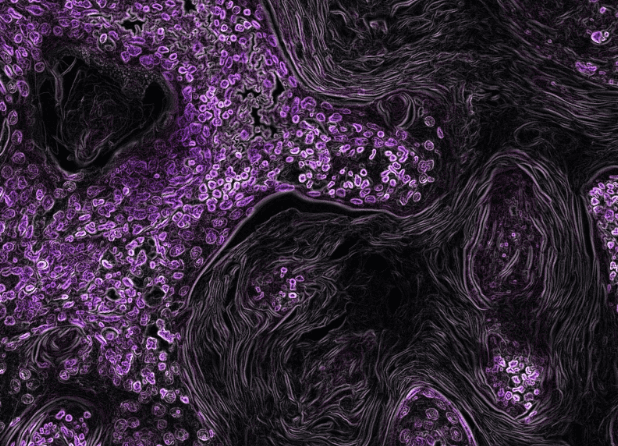

The largest deal this month has been the acquisition of Seagen by Pfizer (NYS: PFE) for $43 billion on December 15, 2023.

Formerly known as Seattle Genetics, Seagen is a biotech firm that develops and commercializes therapies to treat cancers, utilizing the targeting ability of monoclonal antibodies to deliver cell-killing agents directly to cancer cells. The company’s products include Adcetris (approval for six indications to treat Hodgkin lymphoma and T-cell lymphoma), Padcev (bladder cancer), Tukysa (breast cancer), and Tivdak (cervical cancer).

The acquisition will position Pfizer at the forefront of cancer care and complements its existing portfolio across both solid tumors and hematologic malignancies. Seagen reported $2.3 billion in revenue and a negative EBITDA of $650 million for the 12 months ending on September 30, 2023, indicating an estimated implicit 18.7x multiple of revenue.

The Oldest and the Newest

The oldest company to sell in December 2023 was 1857-founded J.D. Johnson, a distributor of plumbing and HVAC supplies based in Poughkeepsie, NY. The company was acquired by Bedford, MA-based F.W. Webb for an undisclosed amount on December 4, 2023. With the acquisition, F.W. Webb is expanding relationships with New York State loyal and growing customer base.

The most recently-founded company to achieve an exit last month was Theia Labs, a developer of an AI-powered personal growth coach app to help stay accountable to your habits, and goals, while also tracking progress towards personalized growth plans. Theia was acquired by Miri, a developer of a wellness platform, for an undisclosed amount on Dec 13, 2023.

Theia Labs was only founded in July 2023, therefore it only took 6 months to see an exit for Founder Mateusz Gacek, a 20-year old sophomore at Indiana University Bloomington!

Growthink Capital’s Transaction of the Month

La Colombe Coffee Roasters, a versatile chain with 32 branded cafes, caters to consumers across various channels, offering custom-roasted arabica bean coffee and an array of delectable snacks.

On December 15, 2023, La Colombe was acquired by Chobani, renowned for its high-quality yogurt products, with backing from its financial sponsor, the Healthcare of Ontario Pension Plan, in a significant $900 million leveraged buyout (LBO).

Earlier, on July 20, 2023, Keurig Dr Pepper acquired a 33% stake in La Colombe for $300 million.

Insights into the synergies of this deal:

- Chobani and La Colombe’s strategic partnership was first showcased with a shared booth at the March 2023 Expo West;

- La Colombe’s Ready To Drink (RTD) product line has experienced over 3x growth in the past 5 years, driven by the increasing demand for cold coffee, a market projected to surpass $5 billion in the next decade;

- Chobani aims to bolster La Colombe’s procurement practices, drive meaningful cost efficiencies, and enhance overall operational performance under its ownership;

- This collaborative approach ensures knowledge sharing between the companies while preserving the unique identities and innovation that define both brands.

To explore M&A alternatives for your business – whether that be pursuing a sale of the company, liquidity for shareholders, or growth-by-acquisition opportunities – please reply to this email, call us at (213) 927-3968, or learn more about our services on our website.

Securities transactions are conducted through GT Securities, Inc. Member FINRA/SIPC. Nothing in this email should be regarded as an offer to sell or a solicitation of an offer to buy any Investment.