ON THIS PAGE

- How to Start a Nonprofit Startup

- How Big is the Nonprofit Industry?

- Where are U.S. Nonprofit Organizations Located?

- What are the Key Sectors of the Nonprofit Industry?

- What External Factors affect the Nonprofit Industry?

- Who are the Key Competitors in the Nonprofit Industry?

- What are the Key Customer Segments in the Nonprofit Industry?

- What are the Key Costs in a Nonprofit Organization?

- What are the Keys to Launching a Successful Nonprofit?

- How Much Money Can a Nonprofit Founder Make?

- How to Start a Nonprofit FAQs

- Helpful Videos

- Additional Resources for Nonprofits

- Other Helpful Business Plan Articles & Templates

If you’re looking to start a nonprofit organization, you’ve come to the right place. Since we’re going to show you exactly how to do it.

We’ll start with key Nonprofit Organization industry fundamentals like how big the market is, what the key segments are, and how revenues and profits are generated.

Then we’ll discuss the keys to not only starting a nonprofit business but succeeding in it!

Importantly, a critical step in starting a nonprofit organization is to complete your business plan. To help you out, you should download Non-Profit Business Plan Template.

How to Start a Nonprofit Startup

Nonprofits can provide a vital service to their communities and can be a great way to give back. But before you can start up your own nonprofit, there are some things you need to know.

Defining a Nonprofit Organization

A nonprofit organization is an entity that is formed for the specific purpose of conducting charitable or public service activities. Nonprofits do not make a profit and may receive tax-exempt status from the Internal Revenue Service (IRS) as 501(c)(3) organizations.

The IRS describes nonprofits as those that “provide for the common good and general welfare of people in the community” like youth, social services, housing assistance, and environmental protection.

Steps to Starting a NonProfit

There are a few key steps you need to take in order to start a nonprofit organization.

-

Choose a name for your nonprofit

This is an important step, as your nonprofit’s name will be associated with its mission and goals. You can conduct a trademark search to make sure the name you choose is not already taken.

-

Draft your nonprofit’s articles of incorporation

Your articles of incorporation will outline the basic information about your nonprofit, like its name, purpose, and bylaws.

-

Register with the IRS

You’ll need to file IRS Form 1023, the Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, in order to receive the status of a tax-exempt organization. This can be a long and complex process, so it’s important to consult with an attorney or tax specialist. If eligible, you may be able to apply through the IRS website.

-

Create a board of directors

Your nonprofit will need a governing board to make decisions and oversee its operations. The board of directors should be composed of individuals with diverse backgrounds and expertise.

-

Develop a mission statement

Your mission statement will help you establish your nonprofit’s overall goal. It should be concise, clear, and simple so everyone is on the same page.

-

Enlist key partners

You don’t have to go at it alone! You can find other community members or groups that are interested in your cause to become allies and partners.

-

Raise funds

Fundraising is a key part of any nonprofit corporation, so start planning your campaigns now. Be sure to include online fundraising in your marketing efforts.

-

Create or adopt programs

Your nonprofit should have programs in place that will help achieve its mission statement. This can involve anything from providing services to the community to raising awareness about your cause.

-

Staffing

You’ll need to hire employees to help run your nonprofit. Make sure you have a clear job description for each position and that you set the expectations high for your team.

Finish Your Business Plan Today!

If you’d like to quickly and easily complete your business plan, download Growthink’s Ultimate Business Plan Template and complete your plan and financial model in hours.

The Cost of Starting a Nonprofit Organization

There are a number of costs associated with starting a nonprofit corporation. These include:

- The cost of filing for tax-exempt status with the IRS

- The cost of setting up your nonprofit’s governing body, such as a board of directors

- The cost of creating or adopting programs

- The cost of fundraising campaigns

- The cost of hiring employees

- The cost of maintaining your nonprofit’s website and other online presence

The Benefits of Starting a Nonprofit Organization

There are many benefits to starting a nonprofit corporation, including:

- Tax-exemption status from the IRS

- The ability to receive donations from individuals and businesses

- The ability to apply for grants from government agencies or private foundations

- The ability to partner with other community organizations

- The ability to build relationships with key stakeholders

- The ability to create jobs in the local community

- The ability to make a difference in the lives of others

What are the Revenue Sources for Nonprofits?

Nonprofits can generate revenue in a few different ways:

- Donations – This is the most common source of revenue for nonprofits and can come from individuals, corporations, and private grants.

- Government Grants – This is another common source of revenue for nonprofits, particularly social services, and healthcare providers.

- Investment Income – Nonprofits can earn money through interest payments on savings or investments.

- Service Fees – Organizations that provide a product or service to the public may generate income from transaction fees. For example, a museum may charge an admission fee.

How Big is the Nonprofit Industry?

There are an estimated 1.5 million nonprofit organizations in the United States, and they account for more than 10% of the workforce. The nonprofit sector is also one of the fastest-growing industries, with an estimated growth of 20% compared to the for-profit business sector which has only grown 2-3% over the last decade.

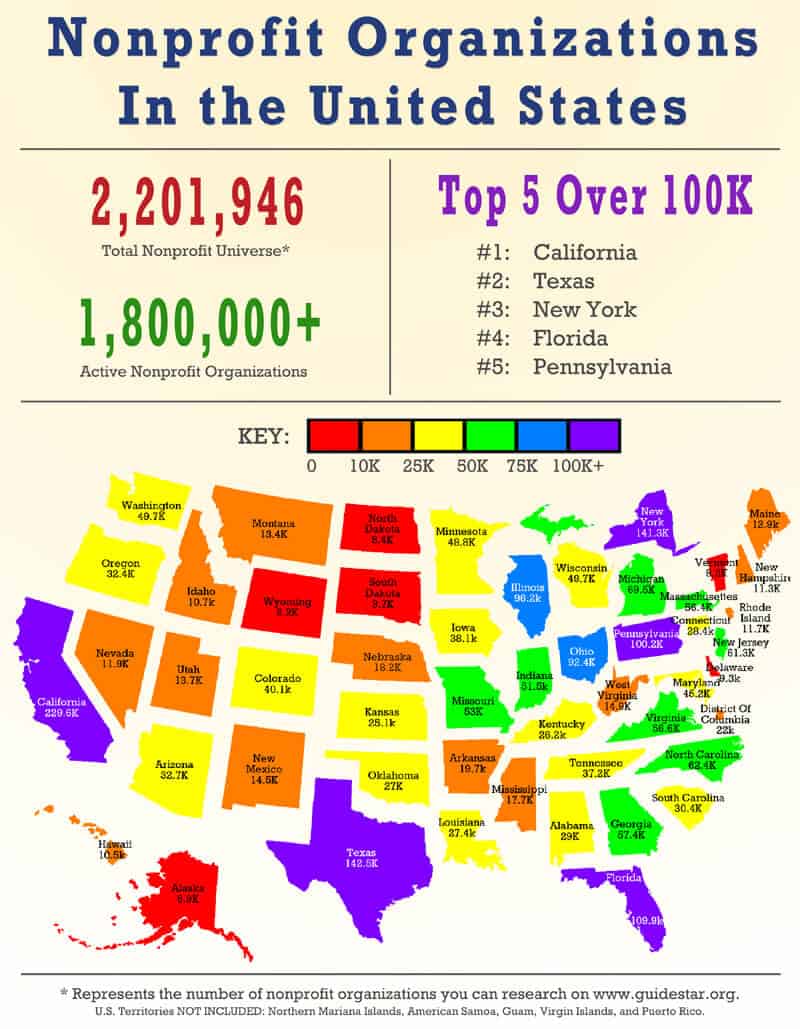

Where are U.S. Nonprofit Organizations Located?

Nonprofits can be found in every state in the United States, but they are most concentrated in California, New York, and Texas.

The infographic below shows the number of nonprofit or charitable organizations by state.

What are the Key Sectors of the Nonprofit Industry?

There are several key sectors within the nonprofit industry:

- Education – More than 2 million students attend private nonprofit educational institutions in the United States. Education organizations include booster clubs, PTAs, PTOs, and financial aid groups. These organizations receive the highest proportion of private contributions.

- Health Care – Health organizations include those dedicated to research, medical care, and the provision of healthy foods and physical activities to children. There are more than 6,000 private nonprofit hospitals and healthcare organizations in the U.S. that provide $1 trillion worth of care annually.

- Social Services – Social service nonprofits provide housing, education, disaster relief, health care, human rights advocacy, and many other kinds of services.

- Arts and Culture – There are more than 100,000 private nonprofit arts organizations in the United States that use art to promote creativity and inspire social change.

- Environment and Animals – Nonprofit environmental organizations work to protect the planet’s land, water, forests, and animals while promoting sustainable ways of living.

- Other Causes – There are nonprofit corporations across the United States that fight for a wide range of social causes, from education to human rights.

What External Factors affect the Nonprofit Industry?

A number of factors affect the performance of the nonprofit industry. These drivers include:

- Public Confidence and Transparency – An increasing number of nonprofits are working to gain public trust by making their finances transparent and undergoing annual ethics audits.

- Purchased Fund-raising Lists – Donor lists are often bought and sold between players in the industry. Brokers and list managers are getting more sophisticated in building lists that are more relevant to individual organizations.

- Favorable Demographics – Older people represent a significant portion of the industry’s donor base. The 65 and older age group is the fastest-growing demographic or population data segment, which represents an opportunity for the industry.

- Internet Donations – Online giving is becoming a larger part of nonprofit fundraising efforts. Though this is not expected to replace traditional methods such as direct mail, it is quickly becoming an indispensable fundraising method.

Who are the Key Competitors in the Nonprofit Industry?

The U.S. nonprofit industry is fragmented: the largest 50 organizations account for about 25 percent of industry revenue. The Mayo Clinic is the top-performing nonprofit in the US, with annual revenues of $8.5 billion. The Bill and Melinda Gates Foundation is in second place, with annual revenues of $6.9 billion.

Nonprofit startups can face direct competition from for-profit businesses with similar missions. For example, an environmental organization may compete with for-profit environmental consulting firms.

Nonprofit organizations also face indirect competition from other nonprofits that are engaged in similar or related activities, including volunteer groups and local community organizations. For example, a charitable organization supporting cancer research could compete with national organizations advocating for the same cause.

What are the Key Customer Segments in the Nonprofit Industry?

The key customer segments in the nonprofit market are:

- Individual Donors – Individuals account for the majority of revenue in the nonprofit sector. They can be broken down into three categories: major donors, mid-level donors, and small donors.

- Corporate Donors – Many large businesses make charitable contributions to nonprofit corporations as a way to give back to the community or to receive positive publicity.

- Government Agencies and Programs – Governments at all levels are major funders of nonprofit and charitable organizations.

- Private Foundations – Foundations are independent, grant-making organizations that support a variety of nonprofit activities.

What are the Key Costs in a Nonprofit Organization?

Taken as a whole, the largest expense for most nonprofit and charitable organizations is fundraising. This is followed by program services, then general and administrative expenses.

- Fundraising Costs – These costs include the cost of acquiring new donors, maintaining relationships with existing donors, and soliciting tax-deductible contributions.

- Program Service Costs – These costs are associated with delivering the organization’s mission, although they generally also include some operating support functions.

- General and Administrative Costs – These costs are associated with managing the organization’s core operations and include salaries for key board members.

What are the Keys to Launching a Successful Nonprofit?

The keys in launching a new nonprofit startup include:

-

Defining the mission

-

Determining the need for the nonprofit

-

Writing a non-profit business plan

-

Building a board of directors

-

Creating an organizational structure

-

Draft governing documents

-

Legal considerations

-

Hiring staff

-

Raising money to support the organization’s activities

-

Launching a marketing campaign

A nonprofit will need to be sure its mission is compatible with a 501 (c)(3) status.

Determining the need for the new nonprofit is essential. This can be done by researching whether there are any gaps in services or unmet needs in the community. Identify the organization’s core activities and who they will benefit.

A business plan will help detail how you will achieve your mission. It specifies an organization’s long-term vision, as well as potential strategies for attaining that goal. It should include specific goals, such as revenue targets or staffing plans, as well as information on what kind of support is needed to meet those goals.

To further guide you in crafting a comprehensive plan, consider reviewing our sample nonprofit business plan.

The board is a nonprofit’s governing body and is critical to the company’s long-term success. They are responsible for setting the strategic direction of the organization and overseeing its operations. It is important to have strong, qualified founding board members that have the time and resources to actively participate in the organization.

The organizational structure defines the roles and responsibilities of each member of the organization. This should be based on the business plan and should be designed to provide the most efficient operation possible.

Nonprofits are required to have Articles of Incorporation, Bylaws, and a Conflict of Interest Policy in order to file for 501(c)(3) tax-exemption status.

Nonprofits are required to incorporate before filing for 501(c)(3) tax-exemption status. Check to see if your state has charitable solicitation law requirements. Finally, a nonprofit needs to ensure ongoing compliance with all state and federal government requirements. Consult an attorney with expertise in the nonprofit sector for additional legal advice.

Staff is essential for running a nonprofit corporation. It is important to hire qualified individuals who share the organization’s vision and values.

Organizations should have a fundraising plan that specifies how funds will be raised, as well as how those funds will be used once acquired.

A marketing campaign, as outlined in the nonprofit marketing plan, is critical for promoting the organization and attracting donors and volunteers. It should be designed to reach the target audience and generate interest in the organization’s work.

What are the Typical Startup costs for a new Nonprofit Organization?

The one-time costs of starting a nonprofit include:

- Legal fees

- Tax-exempt status filing fees

- Fundraising expenses

- Branding and logo

- Equipment

- Salaries

The ongoing costs of running a nonprofit include:

- General and administrative costs such as salaries for admin and support staff, rent, utilities, technology, and legal costs

- Fundraising costs

- Program costs

How Much Money Can a New Nonprofit Founder Make?

It can be difficult to estimate the salary of a nonprofit founder, as this position can vary greatly in responsibility and scope. However, it is important to remember that a salary should not be the main motivation for starting a nonprofit. A few factors to consider when estimating a salary for a nonprofit founder include:

- The size and scope of the nonprofit

- The experience and qualifications of the founder

- The industry in which the nonprofit operates

Estimated salaries for a nonprofit founder vary from $53,555 to $206,709. The median salary for nonprofit founders is $102,910.

How to Start a Nonprofit FAQs

What are the Key Expenses for Nonprofits?

The three biggest expenses for nonprofits include:

- Personnel - This includes salaries and benefits for employees.

- Fundraising - This includes costs associated with soliciting donations from individuals, corporations, and foundations.

- Operating Costs - This includes costs associated with providing products or services to the public, such as maintaining buildings and paying bills.

How are Nonprofits Taxed?

Nonprofits and public charities can receive tax-exempt status under section 501(c)(3) of the Internal Revenue Code if they meet certain requirements. For example, they must be organized for religious, charitable, scientific, literary, or educational purposes and must not directly benefit any private shareholder or individual.

This tax-exempt status prevents the organization from paying federal income taxes, but they must file an annual information return with the IRS, which includes financial information. This tax exemption applies to donations to the nonprofit and to its income. However, there are a few exceptions, such as investment income, which is subject to tax. The organization will receive an IRS Determination Letter once they have approved the nonprofit status.

In addition, some states may impose their state tax exemption or partial exemption. For example, a state may exempt a nonprofit from partial or full property taxes.

How Does the Use of Funds Differ Between For-Profit and Nonprofit Organizations?

There are many differences between how revenue is used in nonprofits versus how revenue is used in for-profit organizations. Some of the most notable differences include:

Investment in Capital Assets - Nonprofits are not allowed to invest in capital assets, such as land or buildings. They can use revenue exclusively for day-to-day operations.

Profit Distribution - For-profit organizations distribute profits to shareholders and investors. However, nonprofits do not have owners and cannot distribute profits among members or employees.

Distribution of Excess Revenue - For-profit organizations can distribute excess revenue to shareholders and investors. However, nonprofits must reserve any excess revenue for future operations; they cannot distribute it among members or employees.

How do Nonprofits Differ From Government Organizations?

There are a few key ways in which nonprofits differ from government organizations:

- Nonprofits are not funded by tax dollars. Instead, they rely on donations, grants, and investment income to generate revenue.

- Nonprofits are typically smaller in size than government organizations.

- Nonprofits are governed by boards of directors, whereas government organizations are typically governed by elected officials.

- Nonprofits are not required to comply with the same regulations as government organizations. For example, they are not subject to Freedom of Information Act requests.

What are the Roles and Responsibilities for Employees of a Nonprofit?

Nonprofits rely on a large number of volunteers and paid employees to carry out their work. It is important that each member's roles and responsibilities are clearly defined, as this helps the organization operate more efficiently.

These roles may include:

- Executive director – The executive director is responsible for managing the organization and implementing its strategic plan.

- Program directors – These individuals are responsible for developing and managing programs that support the nonprofit’s mission.

- Fundraising director – The fundraising director is responsible for raising money to support the organization’s activities.

- Development director – The development director is responsible for building relationships with donors and potential donors.

- Marketing and communications director – The marketing and communications director is responsible for promoting the organization and generating interest among donors, volunteers, and potential clients.

- Finance director – The finance director is responsible for managing the financial aspects of an organization, including budgeting and planning.

- Human resources manager – This individual is responsible for hiring staff members, training staff, and ensuring that all employees are qualified, professional, and share the organization’s vision.

What are the Common Challenges for New Nonprofit Startups?

The key challenges in the establishment of a new nonprofit startup are:

-

Lack of experience

-

Lack of resources

-

Lack of governance

-

Limited exposure

-

Lack of knowledge

-

Competition from established nonprofits

-

Micro-level issues

-

Compliance requirements

-

Limited support

-

Difficulty in sustaining operations

New nonprofits often lack the experience needed to carry out all of the necessary tasks. This can make it difficult to get started and can lead to mistakes.

Nonprofits typically have limited resources, which can make it difficult to accomplish their goals. This includes a lack of money, staff, and volunteers.

New nonprofits are often unable to construct a strong, capable board of directors. This can make it difficult to have the best possible governance structure.

Nonprofits often have limited exposure to the public, which can make it difficult to attract donors and volunteers.

There is a lack of knowledge among the general public about what nonprofits do and how they work. This can make it difficult to raise awareness and support for these organizations.

Established nonprofits often have a significant advantage over new organizations. This can make it difficult for a new nonprofit to survive and the organization may need a new, innovative approach to its work.

New nonprofits often face micro-level issues, such as lack of knowledge about how to start a nonprofit corporation, limited funding to support their work, and limited exposure among the general public.

New nonprofits must abide by compliance requirements for tax-exempt status. This can make it difficult to get started if the organization is not yet tax-exempt or if there are questions related to its tax-exempt status.

New nonprofits often have difficulty finding people who are willing to provide them with support, including technical and financial support.

Many new nonprofits find it difficult to sustain their operations over the long term. This can be due to a lack of funds, volunteers, or other resources.

Where Can I Download a NonProfit Business Plan PDF?

You can download our nonprofit business plan PDF template here. This is a business plan template you can use in PDF format.

Helpful Videos

Launching a New Nonprofit Organization: Your Road Map to Resources

TEDxClaremontColleges – Allen Proctor – A Vision for Successful Nonprofits

NonProfit Business Plan Example PDF

Download our nonprofit business plan pdf here. This is a free nonprofit business plan example to help you get started on your own nonprofit plan.

Additional Resources for Nonprofits

For additional information on the hedge fund market, consider these industry resources:

- National Council of Nonprofits: www.councilofnonprofits.org

- National Center for Charitable Statistics: nccs.urban.org

- GuideStar: www.guidestar.org

- Nonprofit Mavericks: www.nonprofitmavericks.com

How to Finish Your Non-Profit Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Non-Profit Business Plan Template you can finish your plan in just 8 hours or less!

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success.

Click here to see how Growthink’s business plan consulting services can create your business plan for you.

Business Plan Template & Guide For Small Businesses

Business Plan Template & Guide For Small Businesses How To Write A Great Business Plan

How To Write A Great Business Plan 100 Business Plan Examples To Use To Create Your Plan

100 Business Plan Examples To Use To Create Your Plan