This guide to angel investors results from 20+ years of Growthink helping entrepreneurs and businesses raise angel funding. Over this time, we have helped pitch thousands of angel investors, hosted angel investor gatherings, and even had many angel investors as clients.

Below you’ll learn everything you need to know about angel investors and how to get them to fund your company.

Check out Angel Investor Formula

Our comprehensive and proven blueprint for raising capital from angel investors.

Learn more here.

Here’s an outline of this angel funding guide:

- What are Angel Investors?

- What Does an Angel Investor Do?

- How Do Angel Investors Work?

- How Do Angels Differ from Venture Capitalists (VCs)?

- The Value that Angel Investors Offer

- Advantages and Disadvantages of Angel Investments

- What Angel Investors Look Like

- Why Angel Investors Invest

- What Sectors Angels Invest In

- What Angel Investors Look For in a Company

- The Return on Investment that Angel Investors Require

- Step-By-Step Action Plan For Raising Capital from Angel Investors

- Angel Investing Groups List By State

What Are Angel Investors?

The term “angel investor” is officially defined as a private investor who offers financial backing to an entrepreneurial venture.

When several private investors form an organization to collectively fund ventures, they are known as an “angel investor group.”

The act of providing financial backing is known as “angel investing.”

The amount of angel financing is significant. According to the Center for Venture Research at the University of New Hampshire, 66,110 ventures were funded by angel investors totaling $23.1 billion last year.

This compares to only 8,948 companies that venture capital firms funded, although VCs invested $130.9 billion in these firms.

Part of why angel investing is so prevalent is that there are numerous stories of companies who raised angel capital in their nascent stages and then achieved massive success. Among many others, companies that raised angel investments include Google, Amazon.com, Apple, The Body Shop, Kinko’s, Starbucks, Digg, and LinkedIn.

What Does An Angel Investor Do?

So what does an angel investor actually do for a business?

An angel investor can provide a number of resources to a company, but typically they will:

- Help the company grow and scale by bringing important industry connections and expertise

- Serve as a sounding board for the company’s ideas and strategies

- Help the company network to other investors and business people

- Bring publicity to a new venture by writing articles, attending conferences, and meeting with the media

- Invest in a small equity position that serves as an initial financial investment into a promising new venture

Keep in mind, most angels are not professional investors. They do not make a major effort to regularly raise capital from accredited investors, but rather focus on their personal investments in the companies of like-minded people who are trying to build something great.

Check out Angel Investor Formula

Our comprehensive and proven blueprint for raising capital from angel investors.

Learn more here.

How Do Angel Investors Work?

In angel investing, a small investment is made into a business that has yet to begin operating or has a product built. An angel, or “seed” investor, will typically invest from $25,000 to $500,000 in early-stage businesses.

In exchange for the investment, the angel often receives convertible debt or preferred stock in the company. The terms of this agreement are negotiated between the startup and the investor.

The idea behind convertible debt is that it gives the start-up more time to achieve profitability or a liquidity event before the angel converts the debt into equity. This can be helpful for business startups that may not have immediate plans to go public or be acquired.

Preferred stock, meanwhile, typically comes with voting rights and other protections that help ensure the angel is first in line to recover their investment if the company fails.

In return for the angel backing, entrepreneurs will give up anywhere from 1-10% of their business. Most angels never expect to receive a payout on their original investment because they prefer a long-term growth strategy which leads to an exit that is appropriate for all parties involved.

How Do Angels Differ from Venture Capitalists (VCs)?

| Angel Investors | Venture Capitalists | |

| Type of Business | Startups, Small Businesses | Existing Businesses with Proven Track Record |

| Size of Investment | $25,000 – $500,000 | $2M – $10M |

| Type of Investment | Convertible Debt or Preferred Stock | Stake of the Company – Usually 30-50% |

| Funding Timeline | 3 – 6 Months | 4 – 6 Months |

| Investor Experience | Not Professional Investors – Usually Business Owners or Retired Executives | Professional Investors |

| Whose Money Is It? | Invest Their Own Money | Invest Other’s Money |

| On the Board? | Maybe | Yes |

| Expected ROI | Usually 10-35% | Goal is 10X return |

The Value that Angel Investors Offer

Angel investors provide value beyond the actual dollars they invest in your company. Because angel investors are usually successful business owners and executives with vast networks, they:

- Have contacts in their networks that can help your business

- Provide advice in running your business

- Can refer contacts for additional sources of capital

Advantages and Disadvantages of Angel Investments

| Advantages | Disadvantages |

|

|

What Angel Investors Look Like

The Center for Venture Research at the University of New Hampshire, which researches angel investments, has found that the average angel investor is 47 years old with an annual income of $90,000, a net worth of $750,000, is college-educated, has been self-employed, and invests $37,000 per venture.

While the Small Business Administration and other organizations estimate the number of active angel investors in the United States to be 250,000, the number of potential angel investors is much greater. According to TNS Financial Services, 9.3 million households in the United States have a net worth exceeding 1 million dollars. Three million of these households, according to Merrill Lynch & Co. and Capgemini Group, have investable assets of at least $1 million, excluding their primary homes.

We consider this 9.3 million figure to be the best estimate of the number of potential angel investors in the United States. The vast majority of these individuals are “latent angels,” defined as individuals who have the necessary net worth but have not made an investment. These individuals are often the best potential investors in a venture since they have the funds but aren’t bombarded with possible deals (unlike angel groups and venture capitalists constantly bombarded).

Most active angel investors are current or former entrepreneurs, successful executives, or otherwise wealthy individuals. Note that sometimes a venture capitalist will see a deal that is not a good fit for their venture capital funds but which they like, and thus may invest personally as an angel investor. Because, as discussed earlier, angels are often individuals with extensive business experience who have operated and owned successful businesses of their own, they can often provide more value to your business than just the money they invest.

Check out Angel Investor Formula

Our comprehensive and proven blueprint for raising capital from angel investors.

Learn more here.

Why Angel Investors Invest

Angel investors usually invest in privately-held companies for the following reasons:

They think they can get a solid return on investment. Investing at the earliest stages for a company that eventually goes big can earn the investor 100X their money back or more.

According to the Center for Venture Research, angel investors expect an average 26% annual return at the time they invest, and they believe that about one-third of their total investments are likely to result in a substantial capital loss.

They know, like, and trust the entrepreneur. Like with friends and family investments, sometimes angels know and trust the entrepreneurs and want to help them succeed.

They feel they can add real value: many angels have lots of relevant experience to help the companies they fund, from experience hiring staff to connections with key potential customers or suppliers. If angels can see their involvement adding a lot of value to the company, they might be very interested in investing.

Sometimes, the angel wants or likes the action. Simply put, investing is exciting. It is generally a higher risk/higher reward version of the public stock markets requiring a more entrepreneurial analysis which is highly intriguing.

Be sure to keep the above five motivations in mind as they can help you secure angel funding for your business.

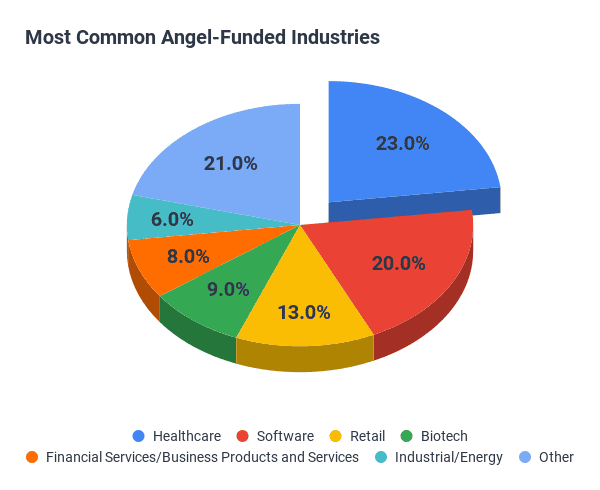

What Sectors Angels Invest In

The following presents a breakout of the sectors in which angels recently invested:

Even though they generally don’t allow for the higher returns of other sectors, the key reason why retail deals can reap investments are as follows:

There are over 9 million latent angel investors, most of which have never been asked to invest in a private company.

Angels often invest when “they feel they can add real value” and virtually always only invest when they understand the business. Because retail businesses are frequented by angel investors, they tend to understand the businesses and believe they can add value.

Finally, note that with retail establishments like restaurants, there is also the ego element that the angel can go to and tell friends that it is partially “their” restaurant. This ego factor also holds true with other types of investments.

Angels invest in all sectors, but the ones listed above are the most prominent.

What Angel Investors Look For in a Company

To consider investing, angel investors must believe that the company has great potential to achieve a liquidity event and one that enables them to earn a significant return on their initial investment. The following factors imply that a company has this potential:

The first criterion is the scale or the potential for the company to achieve significant annual revenues. If a company expects to raise venture capital after the angel round, it must have the potential to earn annual revenues of $50 million to $100 million within five years.

Conversely, an angel investor, when no follow-on capital is required, might be willing to invest in a restaurant or website that has the potential to generate hundreds of thousands or a few million dollars as long as a clear path has been laid out regarding how they could get a sizable return on their investment.

The second criterion is the barriers to entry. Barriers to entry are those things that make it difficult for another firm to compete against you, such as patents or proprietary technology, a unique location, and long-term customer contracts.

The third criterion is having a solid management team with relevant experience and successes under their belts. The angels must believe in and be comfortable with both the founders and the critical operating personnel of the company.

The fourth criterion is that angel investors need to feel confident of your exit strategy, mainly that the chances are good of eventually having another firm purchase you or your firm going public. It is through the exit strategy that these investors profit from their investment in you.

Another important criterion, while not necessarily tied to liquidity potential, is that angel investors tend to only invest in local companies. Angel investors often like to invest in companies that are close by so that they can visit them often and participate in Board and other meetings. In fact, according to the Center for Venture Research, 70% of investments are made within 50 miles of the investor’s home or office.

Finally, angel investors will only invest when the price is right. If companies price their equity too high, then angels may not have the potential to reap significant returns and thus may not invest.

Check out Angel Investor Formula

Our comprehensive and proven blueprint for raising capital from angel investors.

Learn more here.

The Return on Investment that Angel Investors Require

Angel investors typically provide more capital than friends and family but less than venture capital firms. Specifically, angel financing amounts typically range from $25,000 to $500,000. For this money, angel investors usually gain 10% to 35% of the equity of the company.

Angel investors generally expect to earn returns of approximately 30% from their private company portfolio. Note, however, that you cannot simply offer an angel investor the chance to make a 30% average return on investment (ROI). Why? Because most investments fail to reap any ROI. As such, if half of their investments fail, they would need to earn 60% returns on those that succeeded to realize a 30% average return.

Step-By-Step Action Plan For Raising Capital from Angel Investors

The action plan for raising capital from angel funders and groups is as follows:

Step 1: Preparation

There are several things you need to do to prepare yourself and your company to raise capital from angel investors:

Develop a Solid Business Plan

The plan for your business details the vision of your company and your action plan for achieving it. As such, it is a critical document for angel investors to review.

This business plan template and guide provides a section-by-section overview of how to expertly complete your plan.

Develop Your Private Placement Memorandum

Private Placement Memorandums or PPMs are documents that are provided to potential investors for a private placement of securities.

Specifically, the PPM is a document that includes your business plan plus the following information:

- Summary of Subscription procedures

- How the offering works; e.g., payments; state disclosures, etc.

- Summary of the Offering

- Company overview, # shares, minimum investment, use of proceeds, etc.

- Risk factors

- Use of proceeds

- Management compensation

- Principal shareholders and capitalization table

- Subscription Agreement

- Actual subscription form that investors sign

Private placement transactions are exempt from registration under the Securities Act of 1933 in accordance with one or more statutory exemptions, as discussed in “Regulation D and Other Exemptions from Registration.” The question naturally arises as to which firms need to prepare a PPM and which don’t. The answer to this question continues to change with changing federal regulations, and thus our suggestion is to ask your attorney for advice on this matter.

If you need to create a PPM, use this private placement memorandum template.

Prepare for Due Diligence

Before closing a deal, angel investors (and particularly angel investor groups) will complete what’s known as due diligence, which is a deeper investigation into the details of the business.

The shortlist of the key elements that may need to be prepared include the following:

- Background of the company

- Background of management

- The Company’s business plan

- Financials of the company inception (if applicable)

- Management discussion of company performance (if applicable)

- A capitalization table (list of current equity holders)

- Leases

- Employment agreements

- Purchase or sale agreements

- Previous letters of intent

Make sure you prepare each of these materials beforehand to respond when these items are requested quickly.

Hire the Appropriate Counsel

Your company should be prepared with appropriate counsel, such as a lawyer and an accountant. Regarding legal, legal counsel will be needed to prepare and review your private placement memorandum (if appropriate) and negotiate and finalize the paperwork for the financing transaction(s).

Set Realistic Investment Terms

When you work with venture capital firms and often angel investment groups, they will set the terms of investment (e.g., the price per share, clauses to the financing, etc.)

With individual angels, you and your company will typically set the investment terms, although the angel may negotiate these terms with you.

In developing your investment terms, make sure that the terms are realistic. Keep in mind that the angel investor often takes a substantial amount of risk in an unproven company and should be amply rewarded if the company succeeds. Setting your investment terms too high could prevent you from raising the funds you need to grow your venture.

Step 2: How To Find Angel Investors

When searching for angel investors, you can either search for angel investment groups or individual angels.

How to Find Angel Investment Groups

You can find angel investment groups at the end of this article. Note that angel groups invest geographically, so you need to find a group within 100 to 200 miles maximum of your company headquarters.

It is essential to understand that while angel investment fund groups are a viable funding option, they get tons of potential deals and are thus highly selective. The better bet is often to network and, otherwise, find individual angels (typically business owners and retired industry executives) who know your business and have the capital to invest.

How to Find Individual Angel Investors

Individual angels can be found via:

- Referrals

- Networking at events and through multiple degrees of separation.

- Focused Prospecting

Below is more information about these sources so you can create an angel investors list to target.

1. Referrals

The ideal way to be introduced to an angel investor is through a referral by a mutual acquaintance. Talk to your friends, family members, and service professionals such as your accountant, lawyer, or business advisor and see if they can either invest in your small business or refer you to an angel who can.

Note that once you meet an angel, if they say “no” to investing in your business, don’t stop there. Angel investors generally know other angel investors, so always ask for referrals. These are often the highest quality and most fruitful referrals.

2. Networking

If you can’t find referrals to angels from your current network, expand your network.

Networking through attending events and constantly expanding your network by asking for more introductions from your existing contacts works exceptionally well. It does take time and diligence, so you must stick with it.

Here’s a quick lesson regarding how Google raised its angel round of capital.

Founder’s Page and Brin told their ideas to others in hopes that they would get great advice and connections. And sure enough, it worked. Page and Brin discussed their concept with their computer science professor David R. Cheriton. Cheriton then introduced them to his friend Andy Bechtolsheim.

Bechtolsheim then wrote Google a check for $100,000.

And then, Google raised more money from friends and family.

And through their rapidly growing network of investors and advisors, they met and received angel investments from Ram Shriram, a former Netscape executive, and Ron Conway and Bob Bozeman, partners in Angel Investors.

The “and so on and so on” momentum had begun, and that, coupled with continued success with the development and launch of Google.com, resulted in millions of additional dollars being invested in Google.

If you already know some quality people, speak to them and then refer you to other people. If you feel you don’t have highly networked people that you know, go out and find them.

Go to industry events and conferences and meet people. Befriend them and follow up with them. Then get them to open up their networks to you. And/or meet them on professional networking sites like LinkedIn, Spoke, or Facebook. And then, promote the story of your company to your newfound contacts and prove to them that investing in you and your dream will provide them with significant financial returns.

3. Focused Prospecting

With regards to prospecting for angel investors, consider the statistics mentioned earlier in this report:

According to TNS Financial Services, there are 9.3 million households in the United States with a net worth exceeding 1 million dollars.

Three million of these households, according to Merrill Lynch & Co. and Capgemini Group, have investable assets of at least $1 million, excluding their primary homes

As such, there are up to 9.3 million potential angels for your venture.

Most of these investors are either current or retired executives or business owners. You just need to find them.

Retired Executives

One way to accomplish this is by seeking out retired industry executives online. You can find the names of retired industry executives and often what they are now doing via searches on Google.

For example, if you were seeking angel investors for an aviation company, doing Google searches on “retired Boeing executive” and “former Boeing executive” will produce names of potential business angels.

Likewise, you can find the names of executives and Board members of local companies, contact them and see if they are interested in investing in your company.

Business Owners

Business owners are the best angel investors. They generally have capital, and they can often provide great advice regarding starting and growing your company.

In addition, business owners are easy to find. You can pick up the phone book or drive around to find businesses in your area that seem to be successful. And then strike up a conversation with the business owner. It really is that simple.

Another way to find business owners along with their contact information is to purchase lists from organizations such as InfoUSA and Dun & Bradstreet. These firms allow you to create highly-focused lists. For example, you can buy the contact names of business owners within specific industries, with certain annual revenues, and within particular zip code ranges.

As a result, you can quickly, easily, and cost-effectively create highly-targeted angel funder contact lists. Then, you can call these prospects and use both online and offline networking to get introductions to them.

Step 3: How To Effectively Pitch To An Angel Investor

Once you find angels and angel groups you need to pitch them on one or more of these three important things:

- Investing money in your company

- Investing time in your company as an executive or advisor

- Introducing you to other angels since angels nearly always know lots of other angels

If you are pitching to an angel group, there is generally a formal process in which you first submit your business plan and then present your pitch deck to the group. Whether you pitch to an angel group or individual angel investors, you should always use a slide presentation/pitch deck. It allows you to control the conversation and ensure that all of your key points get mentioned.

Step 4: Closing the Deal

As discussed earlier, be careful not to negotiate complex financing terms nor set valuations too high, or it will hurt your chances of raising additional rounds of capital.

Likewise, it is vital to keep this in mind – you want your angel investors to earn a great reward from investing in your company. They are taking a considerable risk on you and your venture and should be rewarded.

Also, remember that “closing the deal” may be getting referrals to other angels and not a cash transaction. Be thankful for these referrals, as referrals are the root of most deals.

Before closing a deal, individual angels (and particularly angel groups) will complete what’s known as due diligence, which is a deeper investigation into the details of the business. Preparing for this phase beforehand will help speed this process.

Check out Angel Investor Formula

Our comprehensive and proven blueprint for raising capital from angel investors.

Learn more here.

Angel Investing Groups List

Below are the nearly 100 US-based angel investor groups sorted by state.

Jump To Your State:

| AZ | ME | OH |

| CA | MI | OK |

| CT | MN | PA |

| FL | MO | RI |

| GA | MT | SC |

| HI | NC | TN |

| IL | NE | TX |

| IN | NH | VA |

| KS | NJ | VT |

| KY | NM | WA |

| MA | NV | WI |

| MD | NY |

AZ

Arizona Technology Investor Forum

Tempe, AZ

CA

Angels’ Forum

Palo Alto, CA

Band of Angels

Menlo Park, CA

Investors Circle

San Francisco, CA

Keiretsu Forum – Orange County

Orange County, CA

North Bay Angels

North Bay, CA

Sand Hill Angels LLC

Menlo Park, CA

TechCoast Angels

Los Angeles, CA

CT

Angel Investor Forum

East Hartford, CT

Connecticut Angel Guild

Fairfield, CT

FL

Emergent Growth Fund

Gainesville, FL

New World Angels

Boca Raton, FL

GA

Atlanta Technology Angels

Atlanta, GA

Seraph Group

Atlanta, GA

HI

Hawaii Angels

Honolulu, HI

IL

Cornerstone Angels

Northbrook, IL

Hyde Park Angel Network

Chicago, IL

Stateline Angels

Rockford, IL

IN

Irish Angels

Notre Dame, IN

KS

Women’s Capital Connection

Lenexa, KS

Mid-America Angels

Lenexa, KS

Midwest Venture Alliance

Wichita, KS

KY

Bluegrass Angels

Lexington, KY

Check out Angel Investor Formula

Our comprehensive and proven blueprint for raising capital from angel investors.

Learn more here.

MA

Boston Harbor Angels

Boston, MA

Bay Angels

Cape Cod, MA

Beacon Angels

Boston, MA

Boynton Angels

Worcester, MA

Golden Seeds

Boston, MA

HubAngels

Brookline, MA

Launchpad Venture Group

Wellesley, MA

River Valley Investors

Springfield, MA

Walnut Venture Associates

Wellesley Hills, MA

MD

Capital Access Network (Dingman Center of Entrepreneurship)

College Park, MD

ME

ECS Angels

Bar Harbor, ME

Maine Angels

Portland, ME

MI

BlueWater Angels

Midland, MI

Great Lakes Angels

Rochester, MI

Grand Angels

Grand Rapids, MI

MN

RAIN Source Capital

St. Paul, MN

MO

Centennial Investors

Columbia, MO

St. Louis Arch Angels

St. Louis, MO

MT

Frontier Angel Fund

Kalispell, MT

NC

Piedmont Angel Network

Greensboro, NC

NE

Nebraska Angels Inc

Lincoln, NE

NH

eCoast Angels

Portsmouth, NH

NJ

Jumpstart New Jersey Angel Network

Mt Laurel, NJ

NM

New Mexico Angels Inc

Albuquerque, NM

NV

Sierra Angels

Incline Village, NV

NY

Golden Seeds

New York, NY

New York Angels

New York, NY

Rochester Angel Network

Rochester, NY

Seed Capital Fund of CNY

Syracuse, NY

Tech Valley Angel Network

Albany, NY

OH

North Coast Angel Fund

Cleveland, OH

Ohio TechAngels

Columbus, OH

PA

BlueTree Allied Angels

Pittsburgh, PA

Delaware Crossing Investor Group

Doylestown, PA

Robin Hood Ventures

Wayne, PA

Mid-Atlantic Angel Group Fund I

Philadelphia, PA

RI

Cherrystone Angel Group

Providence, RI

SC

Charleston Angel Partners

Charleston, SC

TN

Nashville Capital Network

Nashville, TN

TX

North Texas Angel Network

Fort Worth, TX

Houston Angel Network

Houston, TX

Check out Angel Investor Formula

Our comprehensive and proven blueprint for raising capital from angel investors.

Learn more here.

VA

Active Angel Investors

Vienna, VA

New Dominion Angels

Warrenton, VA

D’Arch Angels

Vienna, VA

Virginia Active Angel Network

Charlottesville, VA

VT

North Country Angels

Vermont, VT

WA

Puget Sound Venture Club

Bellevue, WA

Alliance of Angels

Seattle, WA

WI

Silicon Pastures

Milwaukee, WI

Wisconsin Investment Partners

Madison, WI

How to Create an Elevator Pitch with Template

How to Create an Elevator Pitch with Template Ultimate Guide to Business Startup Funding

Ultimate Guide to Business Startup Funding Ultimate Guide to Getting Venture Funding for Your Business

Ultimate Guide to Getting Venture Funding for Your Business How to Write an Investor Pitch Deck with Template

How to Write an Investor Pitch Deck with Template Growthink’s Ultimate Venture Capital Pitch Template

Growthink’s Ultimate Venture Capital Pitch Template How to Write a VC Business Plan with Template

How to Write a VC Business Plan with Template Download a Free Business Plan Template

Download a Free Business Plan Template How to Make a Successful Business Plan

How to Make a Successful Business Plan 100 Free Business Plan Examples

100 Free Business Plan Examples