If you’ve purchased any of my capital-raising products or followed my essays, you’ve undoubtedly heard me say that you should never send an investor your business plan cold. (By “investor,” I’m mainly referring to venture capitalists and angel investors.)

Rather, you should always start with a “teaser” email. A “teaser” email is an email that “teases” the investor by giving them a bite-sized amount of compelling information about your company.

The goal of the email is to see if they are interested. If they are, you will follow up with more information (maybe your Executive Summary and/or full business plan) with the goal of getting a face-to-face meeting with the investor.

There are two reasons you shouldn’t send your business plan in your initial email. First, you don’t want to “over-shop” your deal. Over-shopping is letting too many investors know about your company. If too many investors know about you, the law of numbers states that many investors will pass on investing in you (remember, most investors passed on the opportunity to invest in Google years ago).

So, if an investor isn’t even interested in your market space or teaser email, they certainly won’t invest in your company. And here’s what can happen — an interested investor asks this investor (the one who isn’t interested in your space) if they’ve heard of your company. That investor says “yes” (since you unwittingly sent them your plan) and that they weren’t interested. And then their disinterest persuades the once interest investor from funding you.

The second reason you don’t want to send out your business plan in your initial email is for confidentiality reasons. You just don’t want your business plan out there for everyone to see. Rather, wait until the investor shows that they are at least somewhat interested in your venture before sending it.

So, now that you know that you should start by sending investors a “teaser” email, the question is what to include in the teaser.

Here’s the answer: the teaser email should include 5 to 6 bullets about your company and should be very short (200 words or less). The goal, once again is simply to create a general interest in your venture so the investor commits time and energy to learning more about it (by requesting additional documents or setting up a meeting).

Your bullets should describe what space your company is in and credentials that make you uniquely qualified to succeed (e.g., credentials of management team, customers serving already or showing interest, etc.).

Now one of my subscribers asked me a great question the other day — what should my subject line be on my teaser emails?

In fact, she said that she felt subject lines such as “Unique Investment Opportunity,” “Please Invest in our company,” and “Great Investment Opportunity” don’t catch investors’ attention and/or could turn them off.

And she is 100% correct here. You should never send emails with subject lines such as these to investors.

So, I put together a few Subject line “templates” for you to use here:

1. Re Your Involvement in XYZ Company

Where XYZ company is a company that the VC has funded and which is in your general space. You would start the email with something such as “based on your investment in XYZ company, I think you will be interested in what we are doing…”

2. “New in XYZ Space” or “XYZ Space Introduction”

Where XYZ is the “space” that you are operating in (e.g., the financial software space). The first line would tie the subject line to what you are doing.

3. Referred by XYZ

Where XYZ is a referral source that knows both you and the investor. This works extremely well, but clearly you must first get the referral.

4. Comment on Your Post About XYZ

Where XYZ is a post that the investor recently wrote on their blog about a subject. In your opening line you explain what you agree with in their post and then tie it to your company.

To summarize, send investors a teaser email instead of your business plan to start. And realizing that they receive hundreds of emails every day asking for funding, make sure your subject line stands out and seems like you’re offering them value.

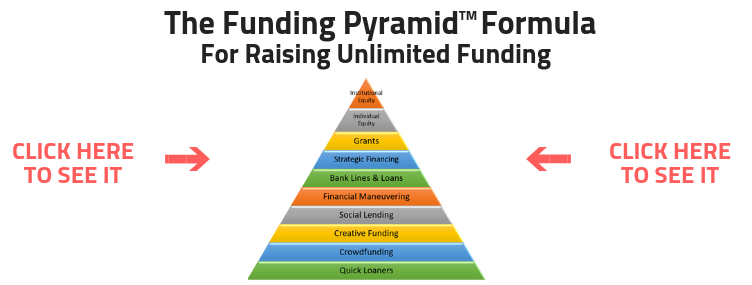

Suggested Resource: Want funding for your business? Then check out our Truth About Funding program to learn how you access the 41 sources of funding available to entrepreneurs like you. Click here to learn more.

Raise Funding Quickly & Easily

If you’re struggling to raise money, it’s probably because your funding strategy is broken.

As I explain when you click, the key is to start at the bottom and work your way up the Funding Pyramid.