Raising funding is hard. This is actually a good thing. Because if it were easy, everyone would raise money and start a business, and competition would be ferocious. Better yet, since most entrepreneurs won’t take the time to read this essay, you’ll know this insider information and have a huge leg-up on them in raising capital.

7 things you must know to raise money for business.

1. Understand That Funding Doesn’t Take Place All At Once

No matter how great your company or idea is, you are probably not going to get a $10 million check right away. Rather, you will typically raise several rounds of capital.

You start with a smaller round or amount of funding. Then, as your business grows, you are eligible for larger rounds of funding. This is because your business proves itself over time (eliminating some risk to investors) and your valuation rises as you grow (enabling you to raise larger sums of money).

2. Choose the Proper Source(s) of Funding

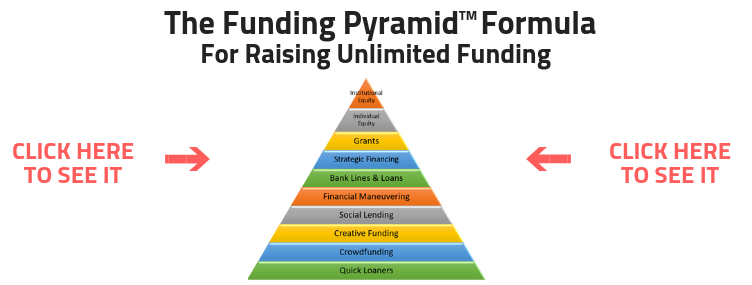

Choosing the right source of funding is the key to the Growthink Funding Pyramid™. Some forms of funding are much easier to raise than others. And based on your stage of development, different forms of funding are more relevant.

For example, the funding sources available to a pre-revenue startup are very different than the sources available to a 3-year old company generating $1 million in annual revenues. Case in point: Google initially failed when it tried to raise money from venture capitalists. The key is to go after the right sources of funding at the right time.

3. Build Relationships Early

According to Fred Wilson of Union Square Ventures, “The perfect entrepreneur/VC relationship is one where each has established respect and trust with the other well before an investment transaction is broached.”

The key is to build these relationships early. So, even if you don’t qualify for a $5 million round of venture capital today, start meeting with venture capitalists so they know you when you do qualify a year from now.

4. Keep Your Business Plan Current

One of the most important things to show in your business plan is what you’ve accomplished in your business to date. And ideally, every month you are accomplishing more. So, be sure to update your plan with this progress.

Importantly, when you meet a lender or investor, you want to be able to give them your business plan in a timely manner. So finish your plan now, and keep it up-to-date, so you can send it off at a moment’s notice.

5. Always be a Marketer

In raising money, the best company doesn’t always win. Rather, the best marketer wins. That is, the entrepreneurs that are best able to market their companies to lenders and investors are the ones who raise the money.

Marketing is the process of finding the right investor, convincing them to meet with you, and then convincing them to invest in your business. Yes, this is very similar to how you market a product or service. So make sure to use your marketing skills.

6. Have “Thick Skin”

When raising funding, be prepared for a lot of “no’s.” Going back to the Google example, even when Google was ready for venture capital, the majority of venture capitalist said “no.”

When an investor says “no,” it doesn’t necessarily mean that your venture is not a good one. It simply means that the venture is not a good investment fit for them. You must have “thick skin” and be able to bounce back from lots of “no’s” and persevere.

When failing over and over again to create the light bulb, Thomas Edison famously said, “I have not failed. I’ve just found 10,000 ways that won’t work.” Have the same mentality with investors. That is, think, “I have not failed. I’ve just found 100 investors that aren’t a good fit.”

7. Adapt as Needed

While you must have “thick skin,” that doesn’t mean to be foolishly stubborn. What I mean by this is that if you hear the same feedback from investors over and over again, you shouldn’t ignore it. Rather, you should adapt.

For example, if several prospective investors tell you they want to see a sample of your product or service before considering funding you, create it for them. Don’t just plow forward with contacting more and more investors in this case.

By adapting to the needs of investors, particularly when you hear the same feedback multiple times, you can make the requisite changes to raise the money you need.

Understanding these seven funding truths will help you raise the funding you need to grow your business. For additional assistance, this “truth about funding” presentation will prove quite helpful.

Raise Funding Quickly & Easily

If you’re struggling to raise money, it’s probably because your funding strategy is broken.

As I explain when you click, the key is to start at the bottom and work your way up the Funding Pyramid.